- Home

- Financial Education

- Budgeting 101

- The Rule of 72

- Investment Education

- Tools & Calculators

- Financial Education Resources

- Demystifying Credit Scores-How Credit Scores Are Calculated

- Debt Management Education and Debt Relief Programs

- Taxes-Cheat Sheet 2024 Taxes & Historic Tax Rates

- Contribution & Income Limits On Retirement Plans

- Glossary of Financial Terms and Definitions

- Services

- Pension Services

- Health Care & Life Insurance

- Area

- About US

- Reviews

- Contact US

- Blog

Unraveling the Mystery - How Credit Scores Are Calculated

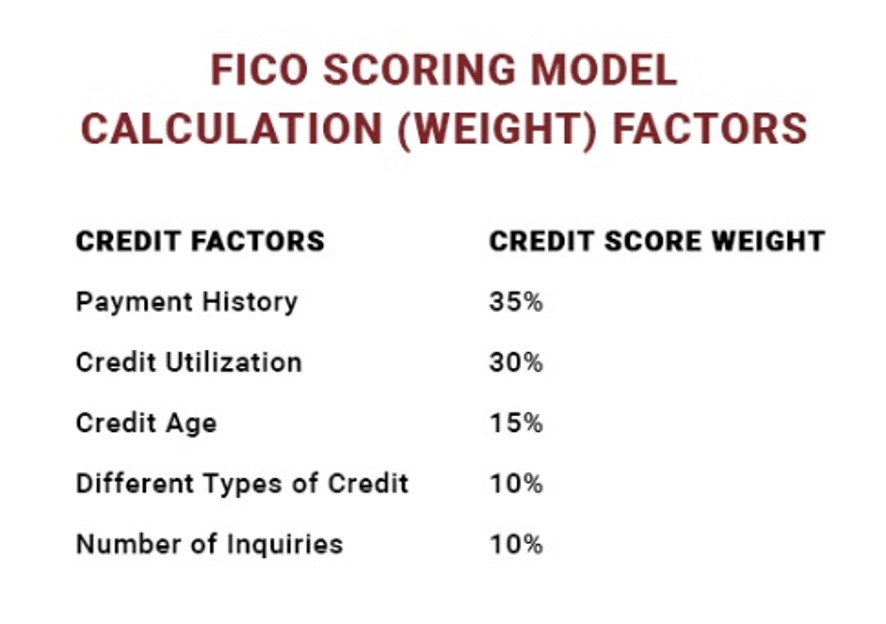

Credit scores are calculated using various algorithms developed by credit scoring companies, with the most common being FICO® Score and VantageScore®. While the exact formulas are proprietary and not publicly disclosed, the general factors that influence credit scores are well-known. Here’s a simplified overview of the factors commonly considered in credit score calculations:

- Payment History (35% of FICO Score):

This factor assesses your track record of making on-time payments for credit accounts, including credit cards, loans, and mortgages. Tardy payments, defaults, bankruptcies, and accounts in collections have the potential to adversely influence your credit score.

- Credit Utilization (30% of FICO Score):

Credit utilization ratio refers to the amount of credit you’re currently using compared to your total available credit limits. Keeping this ratio low (typically below 30%) is favorable for your credit score.

- Length of Credit History (15% of FICO Score):

This factor considers the length of time your credit accounts have been established, including the age of your oldest account, the average age of all your accounts, and the time since your most recent account activity.

- Types of Credit (10% of FICO Score):

Lenders appreciate observing a diverse array of credit accounts, encompassing various types such as credit cards, installment loans (e.g., auto loans), and mortgages. Having a diverse credit portfolio can positively impact your score.

- New Credit Inquiries (10% of FICO Score):

Each time you apply for new credit, a hard inquiry is recorded on your credit report. Too many inquiries within a short period can suggest to lenders that you’re taking on too much debt, which may negatively affect your score.

Unraveling the Mystery - How Credit Scores Are Calculated

Credit scores are calculated using various algorithms developed by credit scoring companies, with the most common being FICO® Score and VantageScore®. While the exact formulas are proprietary and not publicly disclosed, the general factors that influence credit scores are well-known. Here’s a simplified overview of the factors commonly considered in credit score calculations:

The exact weight of each factor may vary slightly between different credit scoring models. Additionally, other factors such as public records (e.g., bankruptcies, foreclosures) and derogatory marks (e.g., late payments, collections) may also impact your credit score.

While the specific formulas are not publicly available, understanding these key factors can help individuals make informed decisions to manage and improve their credit scores over time. Additionally, regularly monitoring your credit report for accuracy and addressing any errors or discrepancies can also contribute to maintaining a healthy credit profile.

Unraveling the Mystery - How Credit Scores Are Calculated

Among the various trade lines, credit cards and loans tend to have the most significant impact on credit scores for several reasons:

Credit Card Accounts (Revolving Debt): Credit cards are a form of revolving debt, and they play a crucial role in determining credit scores due to their influence on credit utilization. Credit utilization, the ratio of credit used to credit available, is a significant factor in credit scoring models. High credit card balances relative to credit limits can negatively impact credit scores, while lower balances are more favorable. Think about it. If you are maxed out on credit, then you are reaching a ceiling. Creditors know that you are in danger and have limited resources to draw on credit.

Installment Loans (e.g., Car Loans, Mortgages): Installment loans, such as car loans and mortgages, also impact credit scores, but typically to a lesser extent than credit cards. Payment history and the length of credit history associated with installment loans are essential factors in credit scoring. Timely payments on installment loans contribute positively to credit scores and demonstrate responsible credit management.

While credit cards and installment loans have the most significant impact on credit scores, other trade lines, such as personal loans, student loans, and lines of credit, also influence creditworthiness. These accounts contribute to factors such as credit mix and payment history, which are important considerations in credit scoring.

Overall, maintaining a mix of different types of credit accounts, making timely payments, and keeping credit card balances low relative to credit limits are essential strategies for managing trade lines effectively and maintaining or improving credit scores.