- Home

- Financial Education

- Budgeting 101

- The Rule of 72

- Investment Education

- Tools & Calculators

- Financial Education Resources

- Demystifying Credit Scores-How Credit Scores Are Calculated

- Debt Management Education and Debt Relief Programs

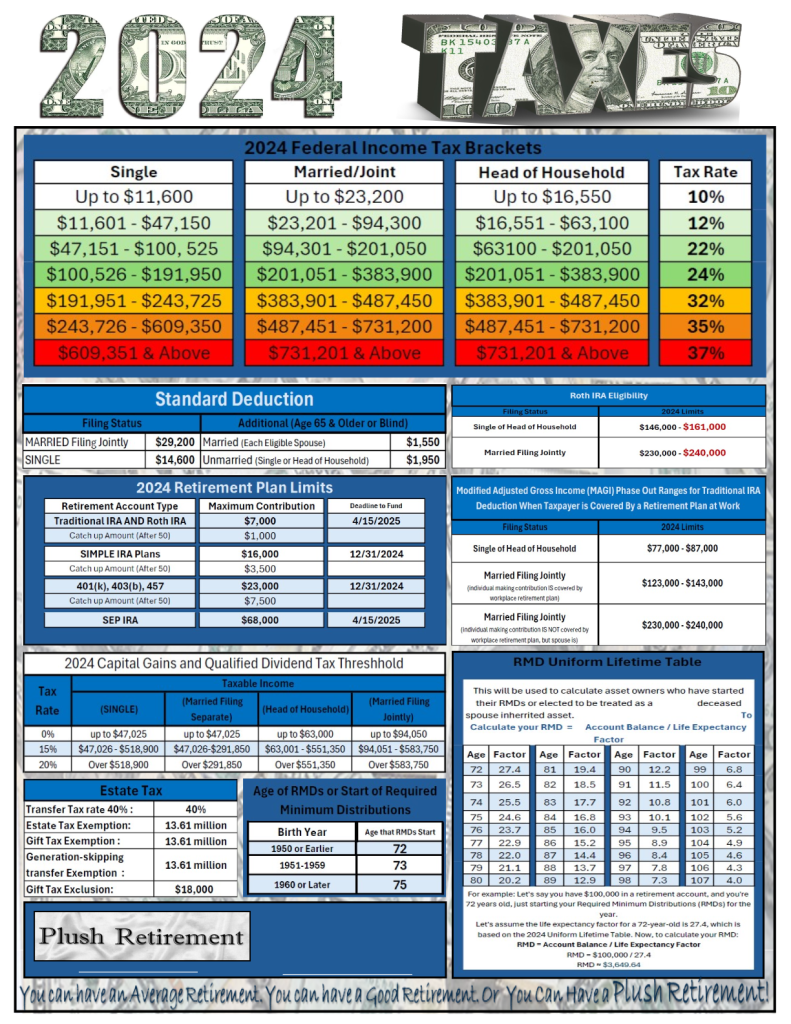

- Taxes-Cheat Sheet 2024 Taxes & Historic Tax Rates

- Contribution & Income Limits On Retirement Plans

- Glossary of Financial Terms and Definitions

- Services

- Pension Services

- Health Care & Life Insurance

- Area

- About US

- Reviews

- Contact US

- Blog

Meet John: He has diligently contributed to his traditional 401(k) throughout his career. As he approaches retirement, he anticipates basking in the fruits of his labor.

Yet, upon reaching the golden years, he faces a harsh reality.

Every withdrawal from his 401(k) nest egg is taxed as ordinary income, subjecting him to the mercy of future tax rates, potentially eroding his savings and compromising his future lifestyle.

Sarah, prudent in her financial foresight, opted for a Roth IRA early in her career. As she embarks on retirement, she relishes the freedom afforded by tax-free withdrawals.

Unencumbered by tax liabilities, she navigates her twilight years with peace of mind, knowing her nest egg remains intact, shielded from the ravages of taxation

Sarah, prudent in her financial foresight, opted for a Roth IRA early in her career. As she embarks on retirement, she relishes the freedom afforded by tax-free withdrawals.

Unencumbered by tax liabilities, she navigates her twilight years with peace of mind, knowing her nest egg remains intact, shielded from the ravages of taxation

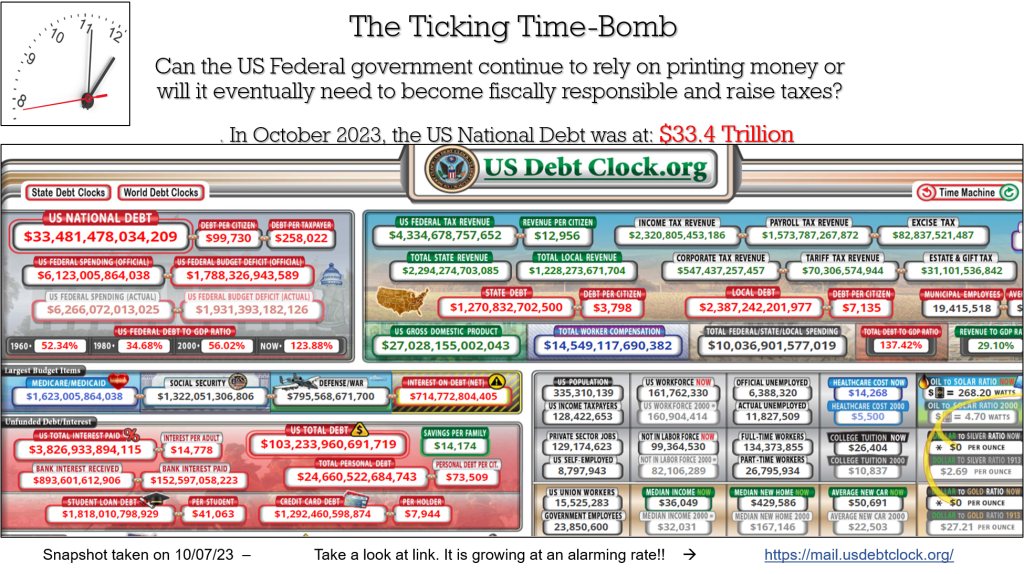

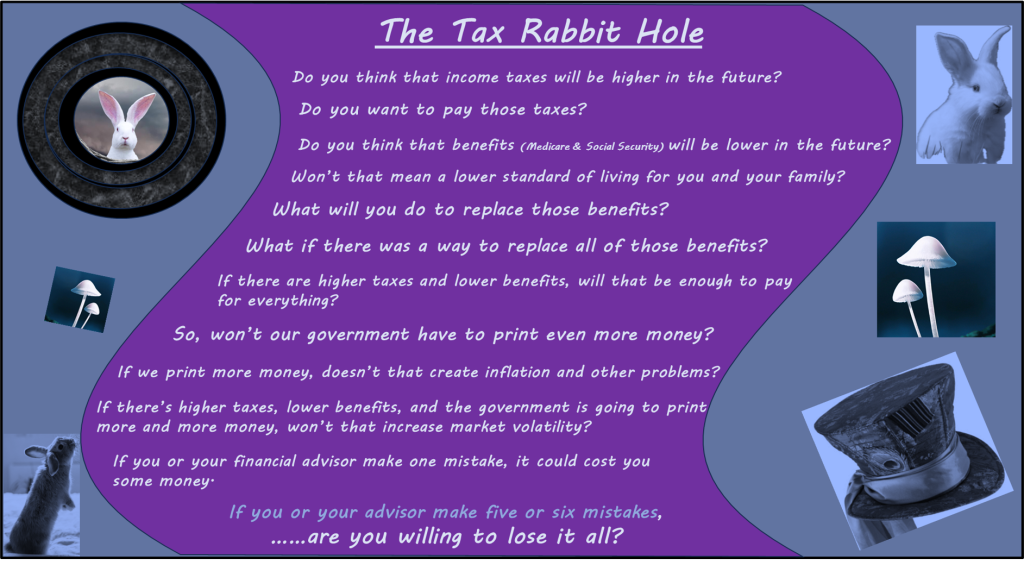

Do you think that the Federal Income Taxes will be….. ….going up or going down?

By 2025 Social Security, Medicare, Medicaid, and the interest on the National Debt will consume 92% of the government’s revenue. It’s shocking to consider how taxes will have to be increased just to keep these programs solvent.

What are you going to do ?

How will you survive the storm?

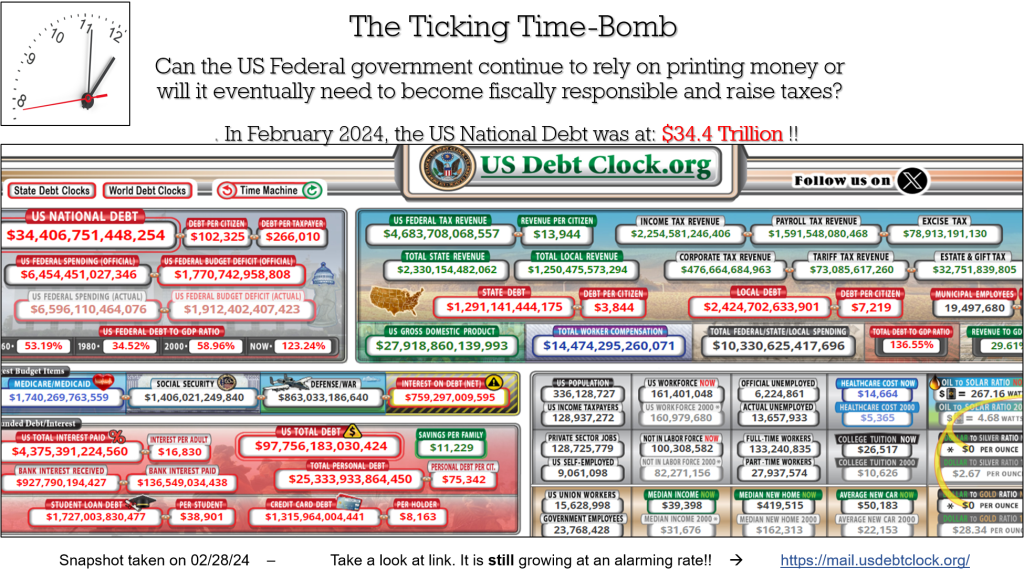

There are approximately 76 million people considered to be a part of the Baby Boomer generation, which represents the largest “oldest” population that we have ever had in the history of the U.S…

By 2031 all the Baby Boomers will have passed the full retirement age.

Then, the next generation, X, will start to retire.

There are approximately 64 million people in Gen X.

If the Federal Government needs to generate more revenue to pay higher debt or even attempt to pay down the deficit, how will they generate the income?

Won’t they have to raise taxes?

When would the best time be to insulate or shelter yourself from taxes, before or after they start to go up?

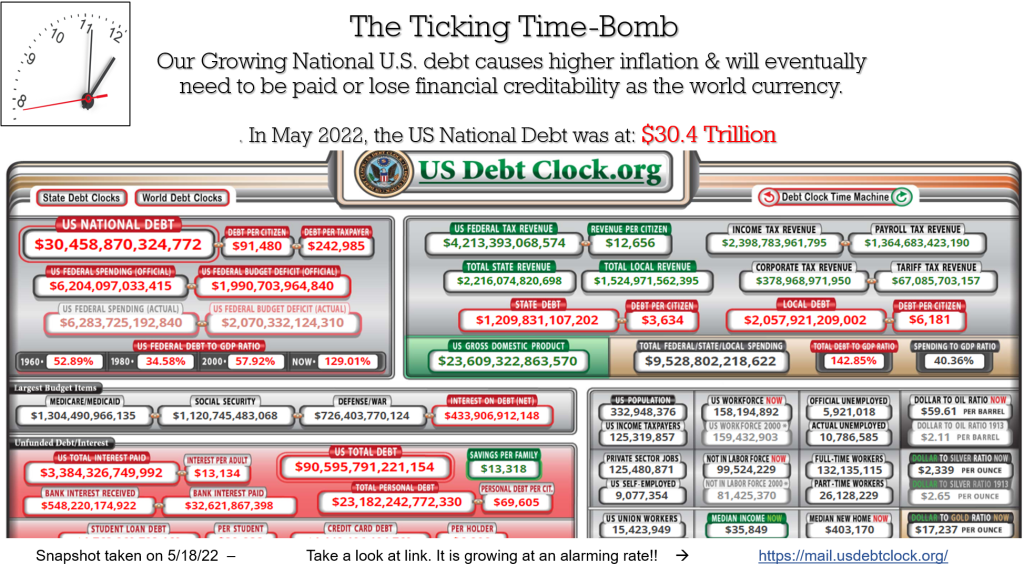

The Ticking Time-Bomb

The Simple Truth is that the US Federal government cannot sustain the amount of debt that we are taking on by printing money alone.

The question of how long depends on four various economic, fiscal, and political factors

- Monetary Policy vs. Fiscal Policy: Printing money, also known as monetary policy, is primarily the domain of the Federal Reserve, the central banking system of the United States. The Federal Reserve manages the money supply to achieve objectives such as controlling inflation and stabilizing the economy. Fiscal policy, on the other hand, involves decisions by the government regarding taxation and spending. While the Federal Reserve can create money through mechanisms like quantitative easing, the government’s ability to raise revenue through taxes is a key component of fiscal policy.

- Inflation Concerns: Printing money excessively can lead to inflation if the increase in the money supply outpaces economic growth. While some level of inflation is normal and even desirable for a growing economy, high or hyperinflation can erode purchasing power and destabilize the economy. Therefore, policymakers must balance the need for monetary expansion with the risk of inflation.

- Debt Sustainability: The US Federal government’s ability to sustain debt depends on its capacity to service that debt over time. High levels of debt relative to GDP can lead to concerns about debt sustainability, as the government may struggle to make interest payments and face higher borrowing costs. Raising taxes can be one way to generate revenue to service the debt and prevent further increases.

- Political Considerations: Decisions about monetary policy and taxation are influenced by political dynamics, including the preferences of elected officials, ideological differences, and public opinion. Political leaders must navigate competing priorities and trade-offs when making decisions about fiscal and monetary policy.

What about US Taxation Historically

The history of federal tax tables and their relationship to the national debt is complex and multifaceted, but here’s a simplified overview:

Early Years (18th-19th Century):

In the early years of the United States, federal taxation was minimal, primarily relying on tariffs, excise taxes, and occasional direct taxes.

The national debt fluctuated significantly, often rising during times of war and falling during periods of peace and economic growth.

Introduction of Federal Income Tax (20th Century):

The modern federal income tax was introduced with the ratification of the 16th Amendment to the United States Constitution in 1913.

Initially, tax rates were relatively low and applied only to high-income earners.

The national debt remained relatively modest compared to later years.

World War I and Interwar Period:

The need to finance World War I led to significant increases in federal income tax rates and expansion of the tax base.

Despite efforts to raise revenue through taxation, the national debt increased substantially due to the costs of the war.

After the war, tax rates were gradually lowered, but the debt remained elevated.

Great Depression and World War II:

The Great Depression prompted the government to raise tax rates and introduce new taxes to address falling revenue and finance relief programs.

World War II further escalated federal spending and debt levels. To fund the war effort, tax rates were raised significantly, and tax brackets were expanded to include more taxpayers.

By the end of World War II, the national debt had reached historic highs relative to GDP.

Post-War Period and Cold War Era:

In the post-war period, tax rates remained relatively high compared to pre-war levels, as the government sought to reduce the debt accumulated during the war.

The Cold War era saw continued high levels of military spending, contributing to fluctuations in the national debt.

Tax policy evolved, with periods of tax cuts and tax reforms aimed at stimulating economic growth and addressing budget deficits.

Late 20th Century to Present:

Tax policy underwent significant changes during this period, including the Tax Reform Act of 1986, which simplified the tax code and lowered tax rates.

The 21st century saw further tax cuts, particularly with the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003 under President George W. Bush.

The national debt increased substantially in the early 21st century, driven by factors such as the War on Terror, financial bailouts, and economic stimulus measures.

Tax tables continued to be adjusted over the years, with changes in rates, brackets, deductions, and credits affecting taxpayer liabilities.

Throughout the 20th & 21st century, the relationship between federal tax tables and the national debt has been one of revenue generation and expenditure. Changes in tax policy have been influenced by various factors, including economic conditions, political priorities, and the need to address budgetary challenges, including the national debt.

- The US Federal Debt has generally trended upwards over the past century, with fluctuations influenced by factors such as wars, economic recessions, and government spending policies.

- Major spikes in the debt occurred during periods of war, such as World War I, World War II, and the post-9/11 conflicts.

- The debt has also increased due to economic downturns, financial crises, and government stimulus measures

To see what tax brackets have been historically between 1862 and 2021

To see what tax brackets are now:

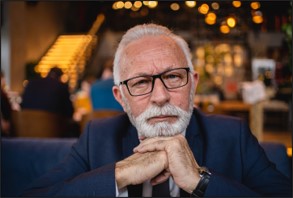

If you’re like most Americans, you’ve saved the majority of your retirement assets in tax-deferred vehicles like 403bs, 457s, 401(k)s, SEPs, TSPs, and Traditional IRAs. But what happens when federal tax rates go up?

How much of your hard-earned money will you really get to keep?

Unless you can accurately predict what tax rates will be when you take those dollars out, do you have any idea how much of that money is really yours?

Are you that much of a fan or the IRS that you want to make them your major beneficiary?

So what’s the solution?

The zero percent tax bracket.

Why?

…… Because if tax rates double, two times zero is still zero!

GET TO THE 0% TAX BRACKET

Would You Rather Pay Taxes!

On the Seed

OR

On the Harvest

TAXABLE INCOME VERSUS

“The Harvest “

403b, 457, 401k, IRA, 529 Plans

Pre-Tax Contributions

Pay taxes at distribution (Retirement)

Penalty if Withdrawal Prior to age 59 1/2 (10% + Ordinary Income Tax)

Either capture gains with no losses or subject to Captures Gains of S&P 500 or other indeces, market volatility

Required Minimum Distributions (RMDs) at age 72. (Must occur by April 1st each year or 50%

Penalty.)

Upon Death: Qualified Account Passes to Spouse. If distributed, then spouse must pay

taxes

Upon Death without Spouse: Passes to children as inherited IRA. If parent was over age 72 when they died, then RMD payment continues and Account must be depleted in ten years.

TAX-FREE INCOME SOLUTIONS

“The Seed “

Life Solution Plans

Post Tax Contributions

Income Tax-Free Money

Access to Money when it is Available. Do not need to wait until Age 59 1/2.

Not subject to Market Loss. Index Strategy Captures Gains of S&P 500 or other indices, but stays at zero if loss for a year (i.e. If the market does well in year 1 and then loses in year 2, then you don’t lose gains from the first year).

No Required Minimum Distribution (RMD) Requirement at any Age.

Upon Death: Income Tax-Free Benefit Passes to Spouse or Beneficiary

Upon Death if No Spouse: Income Tax-Free Benefit Passes to Children, No RMD Requirement.

Pays out if you get a Critical Illness, such as Heart Attack, Cancer, Stroke, Blindness, Renal Failure, ALS, or Loss of Limb.

Pays out if you get Chronic Illness (LTC) – Unable to Perform 2 out of 6 of Activities of Daily Living (Eating, Bathing, Dressing, Toileting, Continence, and Transferring).

Pays out if you become Terminally III (Diagnosed as Less than 24 Months to Live)

Advantages of Index Annuities 403b and IRA’s

“The Harvest”

- Tax Deferred Growth. The principal and interest earned are not taxed until withdrawn. Your funds grow tax deferred with triple compounding of interest.

- Safety. Annuities are among the most guaranteed and safe investments available, along with Banks and the U.S. Treasury.

- Guaranteed Lifetime Income. At any time, Annuities can change from a savings or accumulation vehicle to an income vehicle. Annuities can provide an income that cannot be outlived.

- Interest Crediting. Interest is fixed or tied to the upward trend of the major stock indices. You receive the benefits of stock market gains when the market is up, but none of the losses when the market is down. Sleep at night investing.

- Access and Liquidity. Unlike bank CD’s you have access to your funds during the interest earning time period and can withdraw up to 10% of account value per year.

- FEES. No Contract Fees or Sales Commissions.

- Death Benefit. Your beneficiary will always receive the full account value from the annuity Immediately.

Advantages of Index Universal Life Solutions

“The Seed”

Principal Grows Tax Deferred with Tax Free Retirement

Income

Tax Free Death Benefit

No 591/2 or 701/2 Rule – No Government Involvement

➤ Liquidity – Access to Cash Value for Emergencies, Lifestyle, Access to Credit Line.

Predictable Financial Result / Guaranteed Cash

Growth Accumulation.

➤ Strategies that offer 13.5% interest with the SP500 /Plans with 140% Participation with the S&P500

Tax Free College Savings Planancial services, LLC Flexibility of Contributions (Few Limits)

Flexibility of Distributions

➤ Credit Proof- Protected Assets

➤ Living Benefits included at no cost

o Terminal Illness-90% of death benefit

o Critical Illness-lump sum benefit for heart attack, stroke, cancer, organ transplant, blindness, LG, et.

o Chronic Illness -long term care benefit at 2% of death benefit

O Disability Income-pays monthly benefit

➤ Wealth accumulation vehicle-No Volatility, No Taxes

Life Solutions Plan

Example 1

$200 a month from your Checking Account

Captures Gains of Indices without Loss

5 years: $8,099

10 years: $23,029

20 years: $72,490

Can stop paying after 20 years and let accrue

Can take as Tax Free Income Distribution in Lump Sums or as Income Stream to Supplement Pension

Premature Death-Family Gets the Retirement Value in Advance… In this case: $102K+

Can Access Money for Cancer, Heart Attack, Stroke, Terminal Illness…

Long Term Plan! Must Commit to plan!

Must Pass Health Qualifying Questions

Life Solutions Plan

Example 2

$300 a month from your Checking Account

Captures Gains of Indices without Loss

5 years: $12,258

10 years: $34,933

20 years: $109,948

Can stop paying after 20 years and let accrue

Can take as Tax Free Income Distribution in Lump Sums or as Income Stream to Supplement Pension

Premature Death-Family Gets the Retirement Value in Advance… In this case: $157K+

Can Access Money for Cancer, Heart Attack, Stroke, Terminal Illness…

Long Term Plan! Must Commit to plan!

Must Pass Health Qualifying Questions

Life Solutions Plan

Example 3

$400 a month from your Checking Account

Captures Gains of Indices without Loss

5 years: $16,198

10 years: $46,058

20 years: $144,980

Can stop paying after 20 years and let accrue

Can take as Tax Free Income Distribution in Lump Sums or as Income Stream to Supplement Pension

Premature Death-Family Gets the Retirement Value in Advance… In this case: $157K+

Can Access Money for Cancer, Heart Attack, Stroke, Terminal Illness…

Long Term Plan! Must Commit to plan!

Must Pass Health Qualifying Questions

If you are ready to develop a strategy that will accumulate sufficient wealth for retirement without the IRS getting in your pocket later, let us help!

Set up a complimentary appointment at a time convenient for you at this link: