Quantify Stories

Are your memos & models timely enough

to drive your decisions ?

Our Business thrives

BPN generates AI prompts

Evidence Mapper

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Case Builder

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

SlideDoc Maker

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Memo Writer

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Our Business thrives

Source evidence to support model assumptions

Source evidence to support model assumptions, define logical cases, and get a draft memo and slidedoc summarizing the assumptions and results… Use your own spreadsheet or a BPN template, update the model & memo as information emerges or views change and save versions.

About Us

About Us

1996

Co-Founder Mike Ryan taught co-founder Peter Moore scenario analysis in the preferred Goldman Sachs style. Moore received a Stanford MBA and Ryan became a partner at Goldman Sachs.

2006

Ryan was Co-Head of Global Equity Products at Goldman Sachs. During this same time frame, Moore won multiple National Science Foundation research grants to build a graph database platform to Quantify Stories in Scenarios.

2016

Ryan and Moore licensed BPN’s patented graph database platform to the Harvard Endowment, where Ryan managed $18 billion and was a member of Harvard’s Investment Committee.

Today

Now, they make BPN’s team of fundamental research analysts and patented software available to leverage your domain expertise and research in the BPN Platform.

Services

Who We Serve

Venture Capital

Private Equity

Private Credit Funds

Public Markets

Co-Investors

Family Offices

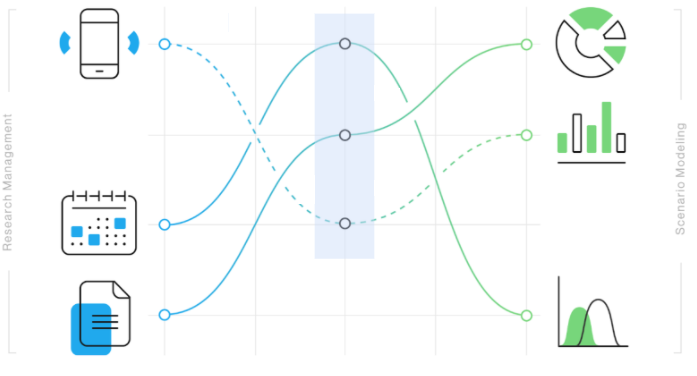

Platform

The BPN Platform’s patented graph database architecture makes it practical to Quantify Stories by integrating

- Research Management

- Scenario Modeling

- Data Visualization

- AI-enabled 'Reading & Writing

Perfected with National Science Foundation grants, 75,000 hours of software development, and 10 years of continuous use by our founders, the BPN Platform leverages proprietary graph database architecture that was purpose-built for investment analysis and strategic decision-making.

All LLMs can summarize documents, but investment decision-making is about translating stories about competitive differentiation, management execution, and market opportunity into a credible framework for future growth, profitability, and scale. This involves numbers, so we enable you to put a spreadsheet at the center of the AI process and make it easy to create as many cases of future cash flow and valuation as you wish to explore.

AI agents need to be directed and supervised. BPN believes in having a ‘human in the loop’ at three critical points: 1) to state the thesis and describe the cases you wish to explore 2) to “own” the “gotta believe” assumptions after seeing all the evidence AI maps to each, and 3) to “own” the conclusion by editing the memo and slidedoc to add nuance and judgment to what AI has produced from the automatic prompts.

Case Builder leverages Evidence Mapper, our AI-enabled research management platform, SlideDoc Maker, our visualization and presentation layer, and Memo Writer, our AI-enabled tool to create a credible first draft memo, to enable your research team, final decisions makers, and any approved 3rd party to:

- Source evidence using AI and human research to keep key assumptions current and well-informed

- Map the evidence to specific assumptions to inform the debate that drives the decision

- Explore upside and downside of each case, or see the expected value across all cases, using our interactive charts and tables

- Create and save your own versions over time to reflect the views of different team members

- Update and timestamp versions as new information emerges or views change

- Displays specific cash flow forecasts, valuation analyses and other key metrics

- Compare alternative investments in a consistent format that highlights differences in assumptions and results

With BPN, your team can start with any spreadsheet and produce a credible first draft memo, model and slide deck in hours instead of days or weeks. You can easily update it as new information emerges or views change over time.

If you want more scalable frameworks than spreadsheets offer, you can model your entire portfolio using BPN’s proprietary Odds Graph Strategic Scenario Models, built by your team with BPN providing training and support.

BPN can also serve as your Challenge Team, providing independent research and conclusions to compare to your own and delivering a complete memo, model, and SlideDoc that you can adapt with minimal effort.