- TX , United States

- Mon - Sun 9am - 5pm

- TX Resident License # 2369721

- CA Non-Resident License # 4241488

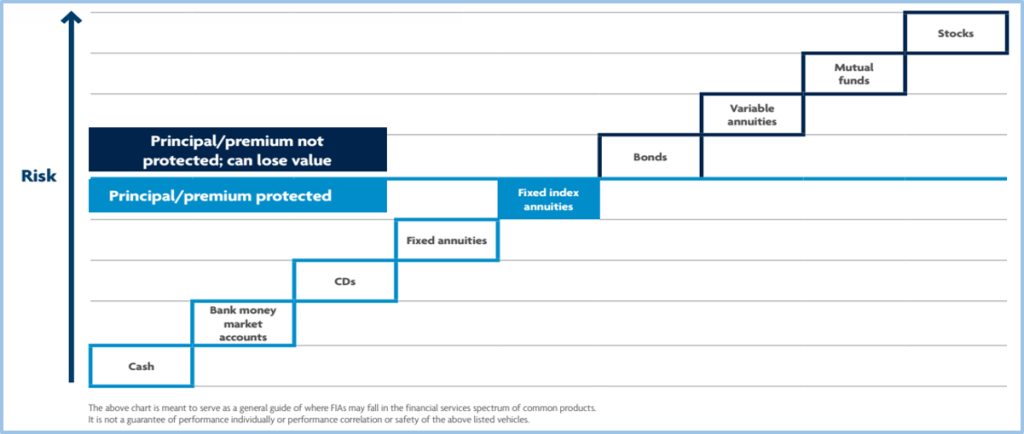

1. Stocks (Equities)

2. Bonds (Fixed Income)

3. Mutual Funds

4. Exchange-Traded Funds (ETFs)

5. Real Estate

6. Commodities

7. Derivatives

8. Cryptocurrencies

9. Certificates of Deposit (CDs)

10. Savings Accounts

11. Annuities

12. Collectibles and Alternative Investments

13. Private Equity and Venture Capital

14. Hedge Funds

15. Money Market Instruments

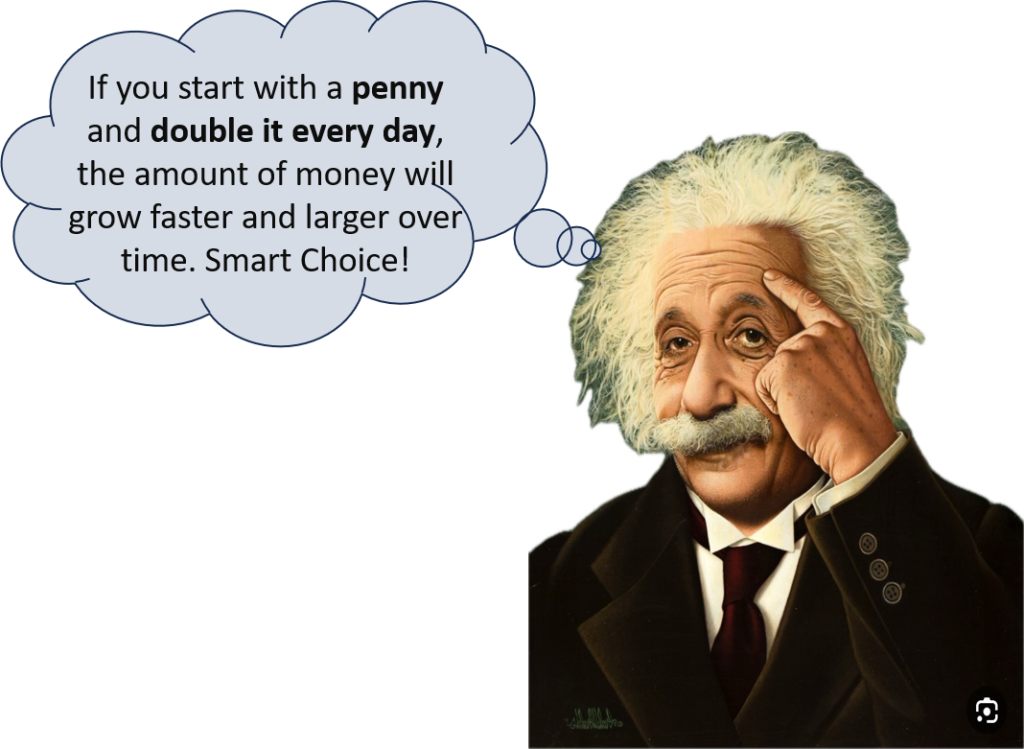

Compound Interest is the 8th Wonder of the World

- Albert Einstein

In the Rule of 72 we can see how long it will take to double our investments, depending on the interest rate.

Now let’s see if you get the concept.

If you were given the choice of:

1.) One million dollars in silver

2.) One penny that you would double every day for a month (30 days) and keep all the change after day 30……

Day 1: $0.01

Day 2: $0.02

Day 3: $0.04

Day 4: $0.08

Day 5: $0.16

Day 6: $0.32

Day 7: $0.64

Day 8: $1.28

Day 9: $2.56

Day 10: $5.12

Day 11: $10.24

Day 12: $20.48

Day 13: $40.96

Day 14: $81.92

Day 15: $163.84

Day 16: $327.68

Day 17: $655.36

Day 18: $1,310.72

Day 19: $2,621.44

Day 20: $5,242.88

Day 21: $10,485.76

Day 22: $20,971.52

Day 23: $41,943.04

Day 24: $83,886.08

Day 25: $167,772.16

Day 26: $335,544.32

Day 27: $671,088.64

Day 28: $1,342,177.28

Day 29: $2,684,354.56

Day 30: $5,368,709.12

Coin Conundrum: If I were to create my own cryptocurrency, I would name it “EcoCoin.” Its unique feature would be its tie-in with environmental initiatives. For every transaction made using EcoCoin, a percentage of the transaction fee would be allocated to environmental conservation projects worldwide. This feature would set EcoCoin apart by not only providing a digital currency but also contributing to global sustainability efforts.

Financial Flashback: The most memorable lesson about money I learned as a child was the importance of saving. My parents encouraged me to save a portion of any money I received, whether it was from allowances, gifts, or odd jobs. This lesson instilled in me the habit of saving from a young age, which has greatly influenced my financial decisions today. I prioritize saving and investing for the future, understanding the value of financial security and long-term planning.

Investment Idol: If given the chance to pitch a business idea, I would choose to pitch it to Warren Buffett. My idea would revolve around a sustainable energy venture focused on developing innovative renewable energy solutions. The pitch would emphasize the potential for long-term growth and profitability while also addressing environmental concerns. Warren Buffett’s expertise in investment and his interest in sustainable businesses make him an ideal choice to present such an idea.

Financial Fortune Cookie: If my bank statement came with a fortune cookie message, I would hope it says, “Your financial discipline will pave the way for prosperity and fulfillment.” This message would reaffirm the importance of prudent financial management and serve as a reminder to stay focused on my financial goals.

Money Milestone Mania: The financial milestone I am most looking forward to achieving is financial independence. This milestone represents the point where I have accumulated enough wealth and passive income streams to sustain my desired lifestyle without relying on traditional employment. When I reach this milestone, I plan to celebrate by taking a well-deserved vacation with my loved ones, enjoying the freedom and security that financial independence brings.

The important thing is that you are now thinking about your finances. Whether silly or not, it is important to give your finances more than a second thought. The more you focus on and educate yourself, the better your relationship with money will be.

It’s not always going to be fun, but those who plan will have a much better retirement, a healthier lifestyle and outlook in life, will be happier, and live longer.